Why Renovation Loans?

Meet Jeff, Your Renovation Loan Expert!

Jeff is your go-to guide for seamless renovation financing. With a wealth of experience, he specializes in turning your home improvement dreams into reality. From tailored solutions to a commitment to client satisfaction, he is your dedicated partner throughout the entire financing process

Ready to Renovate? We're Ready to Help!

Home Loans Made Simple!

Purchase or Refinance

Allowing you to borrow money based on the expected post-renovation value of your house

The Big Threes of Renovation Loans

1. Forms

We've assembled all required forms into a convenient bundled packet, accompanied by a detailed checklist for both borrowers and contractors. Additionally, we offer an Excel spreadsheet designed to calculate renovation loan numbers efficiently. Our fee matrix provides a transparent breakdown of all costs associated with each renovation loan type, ensuring clarity and accuracy throughout the process.

2. Contractor Approval

Our contractors benefit from a specially designed one-pack for renovation loans, offering a streamlined and secure financial process. The unique advantage lies in having dedicated funds set aside, ensuring contractors never have to worry about payment uncertainties; the money is readily available in reserves.

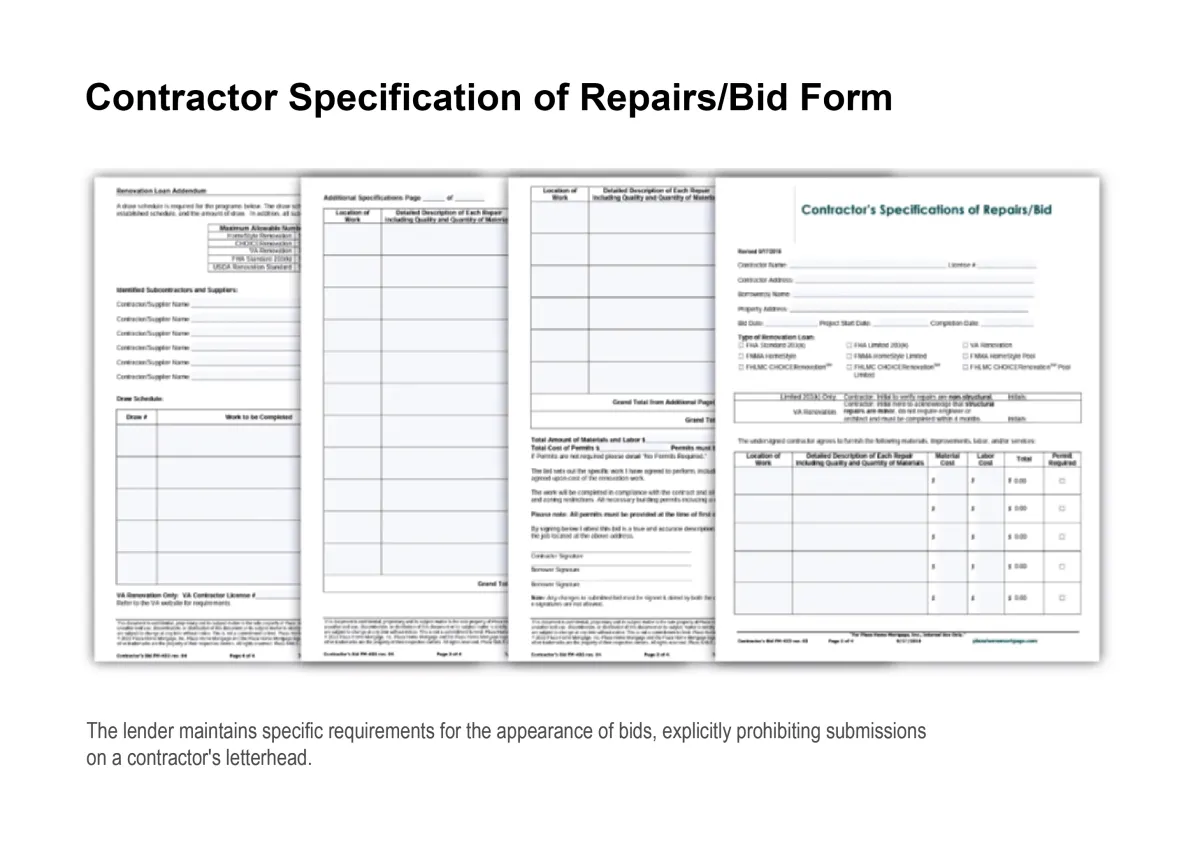

3. Contractor Specification of Repairs/Bid Form

The lender maintains specific requirements for the appearance of bids, explicitly prohibiting submissions on a contractor's letterhead. This stringent approach is driven by the lender's commitment to ensuring the borrower's construction project success. The bid serves as the sole document that outlines the anticipated outcomes and details the scope of the work. This meticulous adherence to bid guidelines is aimed at providing clarity and transparency to borrowers regarding the expected deliverables and the nature of the proposed work.

Our forms simplify the comprehension of the Work Write-Up for repairs and financing, benefiting borrowers, contractors, and HUD Consultants throughout the renovation process.

Why Should I Get a Renovation Loan?

Renovation loans provide the financial means to transform an existing property into a more contemporary and functional space.

Make Your Home Even Better

Boost your home's worth with strategic renovations that offer substantial returns. Choose wisely to enhance both the aesthetic appeal and financial value of your property.

Choose the Right Area and Renovate to Your Liking!

Buyers often discover homes in preferred areas that may not be up-to-date or renovated. In such situations, a renovation loan proves to be an excellent option, enabling them to purchase a property and customize it to their liking.

Renovation Team

Our comprehensive renovation team is ready to address all your questions and provide a range of services to support your renovation needs.

A wealth of resources is at your disposal.

Loan Officer

Architect Designer

Contractor/Subcontractors

HUD Consultant

Real Estate Agent

Insurance Agent

Escrow Officer

We consistently collaborate with new contacts introduced by our clients, assisting them in the renovation of their properties.

As your mortgage team, we have the expertise to assist any of our borrower contacts in renovating their property.

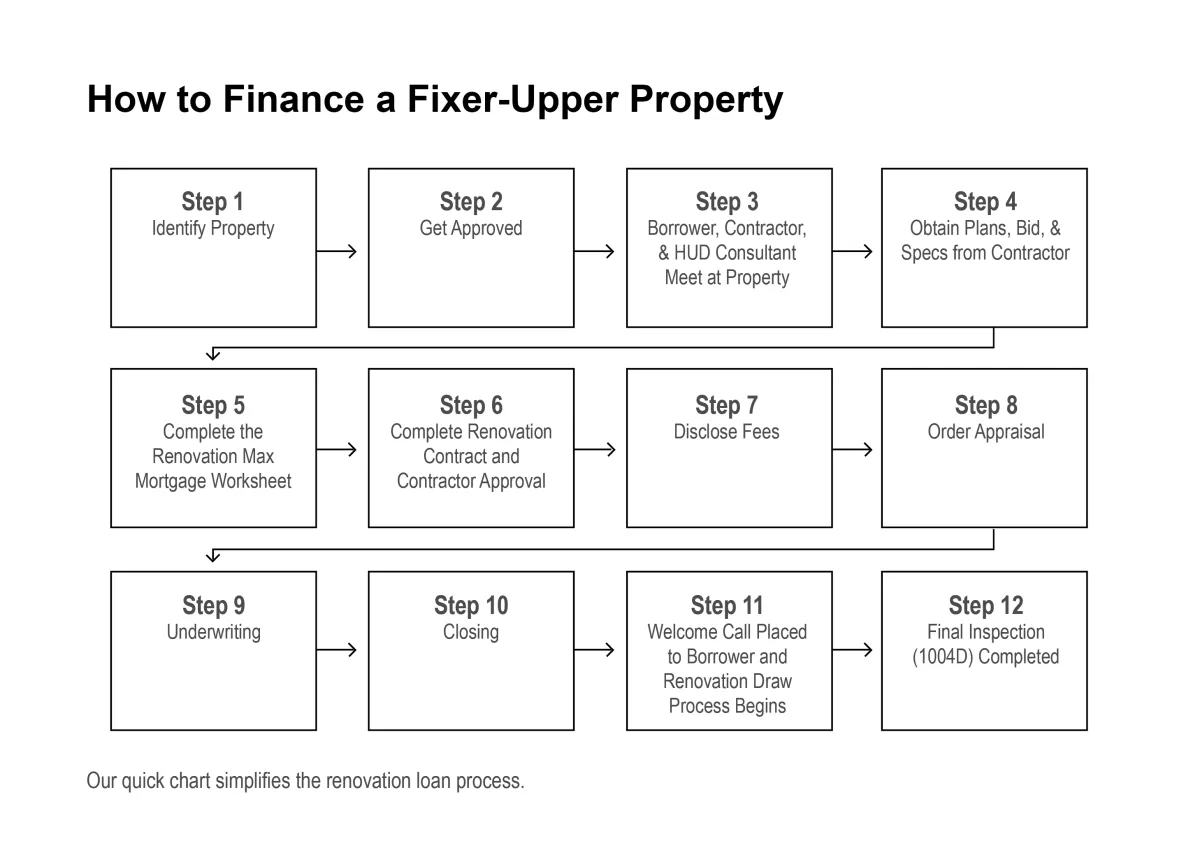

How to Get a Home Renovation Loan?

We are able to close a renovation loan with 30 days?

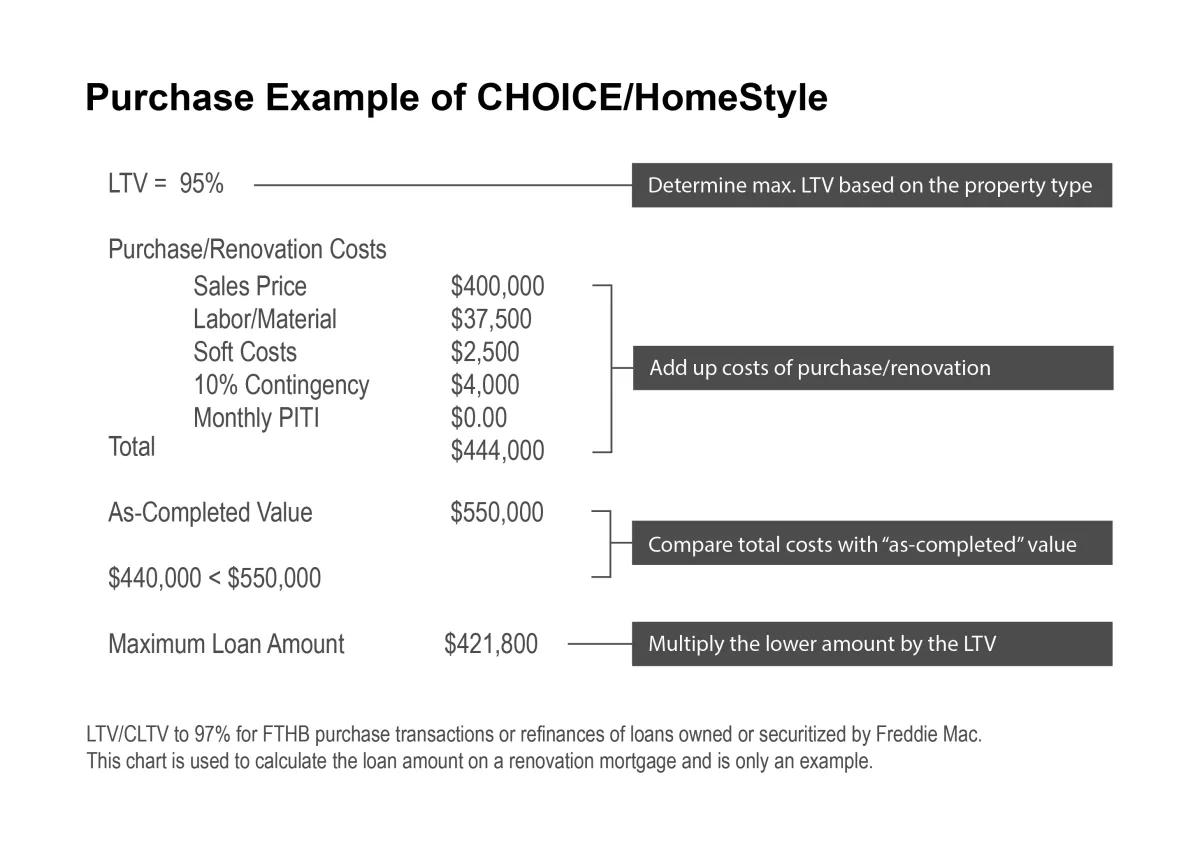

1. Determine Your Renovation Budget and Loan Type

We educate borrowers to identify a purchase price inclusive of renovations, determine an affordable payment, and secure financing for a property.

2. Submit Your Loan Application

We are able to close a renovation loan as quickly as a conventional purchase loan.

3. Complete Bid with Contractor

During the due diligence period specified in the purchase contract, the borrower can efficiently obtain all necessary bids from the contractor.

Don't hesitate to contact us for help throughout the process.

We offer the flexibility to close a renovation loan if needed.

The exciting news is that we can pre-approve a buyer for both a regular conventional loan and a renovation loan simultaneously. When it's time to go under contract, we have the flexibility to close either type of loan based on the buyer's needs—whether it's for a property that requires no repairs or one that does.

Exterior Renovations & Repairs

A renovation loan can be a valuable choice for someone looking to finance exterior improvements on a property.

Addressing roof issues is a common concern when financing an older home, and utilizing a renovation loan can be a practical solution.

Renovation/Repair Benefits:

Appraisal Challenges

Budgeting Convenience

Immediate Repairs

Increased Property Value

Renovation/Repair Ideas:

Roof, Landscaping, Gutters, Outdoor Kitchen Space, Deck, Pool, Siding, Walkways, Pool, Pool House, Decks

Interior Renovations & Repairs

Upgrade appliances hassle-free with a renovation loan. Finance the cost of new appliances, installed by a licensed contractor, to enhance your property seamlessly.

Homes over 25 years old frequently have deferred repairs. A renovation loan allows the financing of both materials and labor needed to address these deferred repairs, providing a comprehensive solution for homeowners.

New Appliances

Renovation/Repair Ideas:

New Appliances, Upgrade Electrical, HVAC, Kitchen, Bathroom, Floors, Etc

Renovate Space

Many properties can be revitalized with a straightforward renovation, bringing a modern touch to existing structures.

Here are some key benefits and considerations:

Improve a Home's Functionality or Attractive

Eliminate Health and Safety Hazards

Plumbing or Sewer System

Electrical

Replace Flooring

Accessibility for Disabled Person

Much More

Which areas in your home hold the utmost importance for you?

Specifically, what enhancements do you envision for your kitchen during the renovation process?

Bathroom

Kitchen

More Living Space

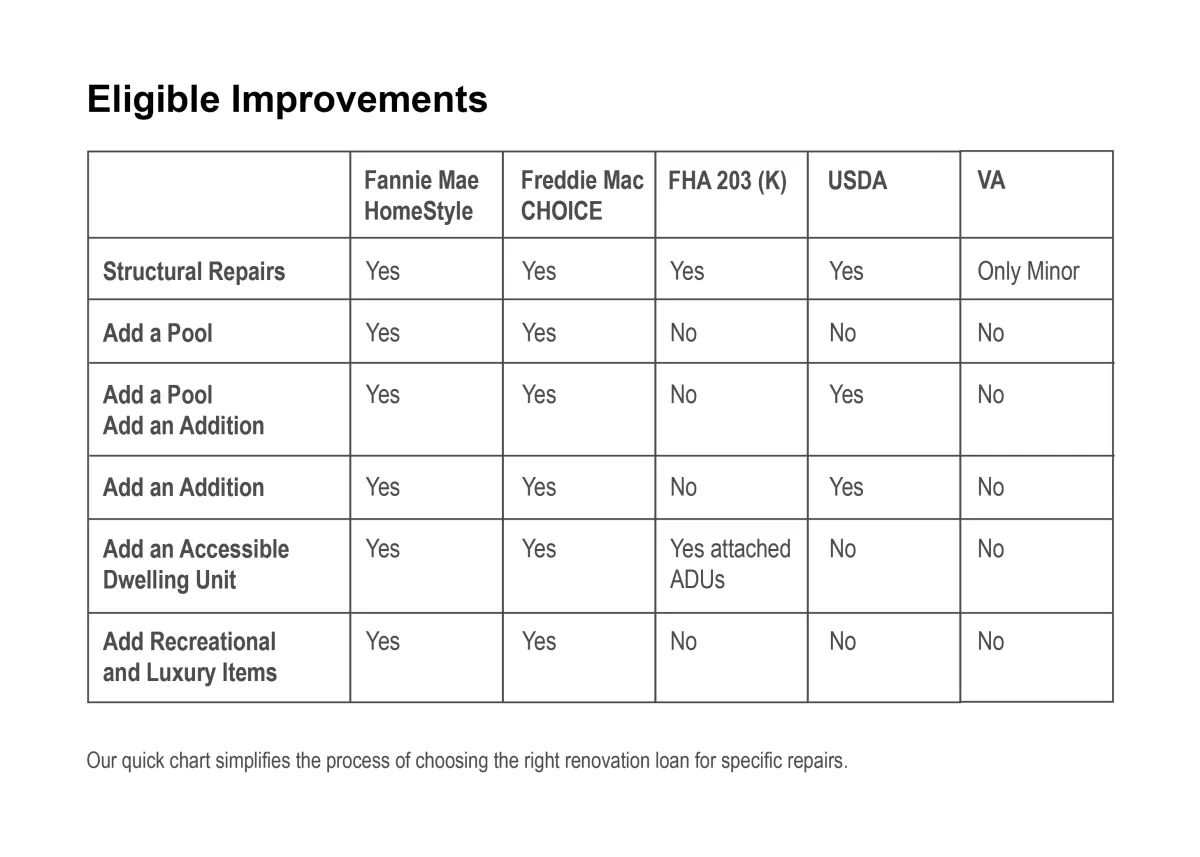

Ineligible Improvements

It's actually easier to explain what improvements that cannot be done.

Project cap set at $350,000, subject to higher limits with underwriter approval.

Improvements leading to commercial use or having a commercial nature restricted.

Conversion of a Single-Family Residential (SFR) dwelling into another SFR dwelling not permitted.

Exclusion of oil tank removal or repair from covered expenses.

Program ineligible for complete tear-down, foundation-up construction, and reconstruction of the dwelling.

Borrower Provided Material

Materials supplied by the borrower may be considered but cannot be included in the financed loan amount.

All materials provided by the borrower must be new, documented with paid invoices, and the source of funds must be well-documented.

Borrower Paid Material Guidelines:

The HUD Consultant is required to provide photos of borrower-supplied materials (if applicable) on-site.

Borrower-supplied materials must be clearly documented on the contractor's bid as borrower-supplied (zero cost).

For example, the contractor's bid could specify for the utility room: new red RC Willey cabinets, zero cost for materials, $1,500 for installation. This information is crucial for the appraiser to accurately assess the property's after-improved value.

Contractors are responsible for providing the labor.

Navigating renovations and repairs can be overwhelming for homeowners handling the work themselves. Hiring a contractor not only adds value by ensuring a smoother process but is also a requirement with a renovation loan.

Working with a Contractor

A renovation loan provides property owners with a streamlined solution to swiftly complete projects on time and within budget. It eliminates the stress of DIY work, ensuring that contractors, with their expertise, can efficiently manage unforeseen repairs that may arise during the renovation process. This approach ensures projects are completed correctly, on schedule, and with minimized hassle for the property owner.

On a VA loan, repairs need to be finalized within a 4-month timeframe, while for all other renovation programs, the completion window extends to 6 months.

Before Closing Loan

Architect / Designer

Customization

An architect or designer plays a crucial role in helping homeowners visualize and plan the direction of their renovation projects.

Contractor

Multiple Projects

A contractor collaborates with the architect and designer to execute the various projects that have been decided upon with the homeowner.

An architect, designer, and contractor can guide a homeowner through the initial goals and provide insights into the costs associated with completing the necessary repairs.

Accessory Dwelling Units

Accessory Dwelling Units (ADU)

Our unique financing option is your sole choice when it comes to utilizing rental income for an Accessory Dwelling Unit (ADU) that hasn't been built yet. With our solution, you can leverage the potential rental income to qualify for the construction of your ADU. Choose the only option that empowers you to turn your ADU plans into reality while maximizing your financial capabilities.

Why Build an Accessory Dwelling Unit?

Long-Term Rental Unit

In Some areas an Airbnb

Children to Live In

Parents to Live In

A Separate Office from the Home

Place for Visitors to Stay

Building an Accessory Dwelling Units:

Build a Tiny Home Free Standing In the Back Yard with home style or choice that is not attached.

FHA 203(K) the ADU has to be attached.

Contact Me About a Renovation Loan

We appreciate your interest in our mortgage services.

Jeff Carlston is a Licensed Loan Officer NMLS #315077 with Augusta Lending Utah NMLS# 353774 Align Lending Michigan NMLS# 2041154

Augusta Lending - Utah

NMLS 353774

Align Lending - Michigan NMLS#2041154

Renovation Loan Flyers

About Renovation Loans

Renovation Loan Webinars

The information provided on this page is for general informational purposes only and is not financial advice. Loan products and terms are subject to change. Specific eligibility and terms may vary based on individual circumstances. This website is not a lender, and loan approval is subject to credit approval by the lender. Use of this site does not create a client-lender relationship.

Any reliance on the information presented is at your own risk. Consult with a qualified loan officer before making any financial decisions. We strive for accuracy but make no warranties about the completeness, accuracy, or suitability of the information. We are not liable for any loss or damage arising from the use of this website. This disclaimer is subject to change without notice. Accessing and using this website indicate your agreement with these terms.