Renovation Loans Guidelines

Meet Jeff, Your Renovation Loan Expert!

Jeff is your go-to guide for seamless renovation financing. With a wealth of experience, he specializes in turning your home improvement dreams into reality. From tailored solutions to a commitment to client satisfaction, he is your dedicated partner throughout the entire financing process

Ready to Renovate? We're Ready to Help!

Home Loans Made Simple!

Why Should I Get a Renovation Loan?

Renovation loans provide the financial means to transform an existing property into a more contemporary and functional space.

Uncover how this financial tool can turn your home improvement dreams into reality while adding significant value to your property.

Here are some key benefits and considerations:

Unlock Your Home's Potential

Affordable Financing

Increase Property Value

Tailored to Your Needs

Transformative Repairs

Maximize Property Potential

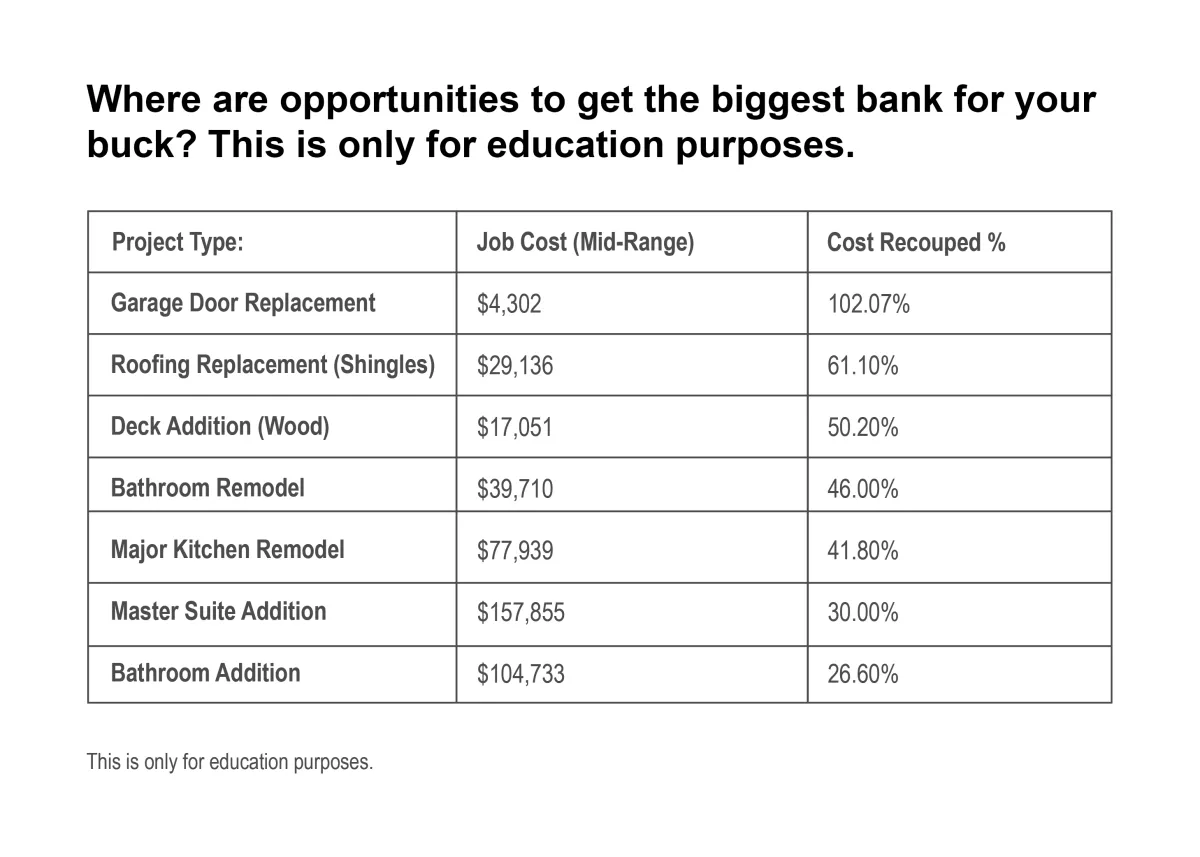

Make Your Home Even Better

Boost your home's worth with strategic renovations that offer substantial returns. Discover the top projects that promise long-term value for your investment. Choose wisely to enhance both the aesthetic appeal and financial value of your property.

Bathroom Boost

Tub

Toilet

Sink/Vanity

Flooring

Fixtures

Lively Landscaping

Fresh Sod

Colorful Plants

Walkways

Pool/Pool House

Outdoor Kitchen

Decks

Exterior Enhancement

Freshen Paint

Replace Siding

Update Entry

Spiced-Up Kitchen

Upgrade Oven

Cooktop

Sink

Fixtures

Flooring

Purchase or Renovation Loans

Your dream home doesn't have to be move-in-ready. With our Single Close Loan, renovation funds are seamlessly integrated into the amount financed. Say goodbye to compromises and hello to the perfect home tailored to your vision. Explore the possibilities today

Unlock a seamless path to your dream home with our single loan financing solution. This all-in-one package covers your mortgage, repairs, and upgrades, all tailored to the As-Completed value of your home. Simplify your journey to a transformed living space – explore our single loan option today!

Transform your current space into your dream home! Personalize your surroundings, make meaningful additions, and upgrade without the hassle of moving. Save on real estate costs and invest in the home you love. Explore the possibilities of enhancing your current living space today!

Renovation loans present a valuable opportunity for homebuyers or homeowners seeking to enhance their properties. These loans offer flexibility by combining home purchase or refinance and renovation costs into a single, streamlined loan. The process involves an appraisal based on the anticipated post-renovation property value, allowing financing based on the future value rather than its current condition.

This financing option unlocks numerous possibilities, allowing individuals to personalize their homes, address maintenance issues, and undertake improvement projects. Renovation lending serves as a comprehensive solution for those looking to turn a property into their dream home while managing costs effectively. Many may not be fully aware of the extensive benefits and possibilities that renovation loans bring to the table. Discover the transformative potential of renovation financing for your property.

School District

Reside in a school district but your home needs repairs? Discover how our renovation loan can help transform your home, making it not only a part of a great school district but also a space you truly love. Explore the possibilities for enhancing your living experience.

Mother-In-Law

Maximize your property investment with a renovation loan. Purchase a single-family home and create additional rental space, turning your property into a dual-purpose asset for potential profit.

Duplex Investment

Optimize your investment by purchasing a duplex, residing in one unit, and renovating the other for rental purposes. With a renovation loan, enhance the overall value of the duplex, generating rental income to cover mortgage expenses and potentially yielding a steady stream of profit over time."

Bring Non-Permitted Items Up to Code!

Purchasing a property below market value due to a county-issued red tag for a non-permitted garage conversion, the buyer strategically leveraged a renovation loan. This approach addresses required permitting and necessary repairs, aiming to bring the property into compliance and enhance its overall market value. By securing the funds needed, the property can be rehabilitated to meet local regulations. Collaborating with professionals ensures proper permits and high-quality renovations, transforming the property into a valuable asset for resale or rental income.

Renovation Loans VS HELOCs for Home Renovation

Renovation Loans

Loan amount takes into consideration proposed renovations.

Rates are lower than HELOCs.

HUD Consultant Available.

Costs are set before construction begins.

No drastic increase in loan payments.

HELOCs

Loan amount is based on the amount of the existing or “as is” equity in the home.

Rates are higher than Renovation Loans.

Borrower is responsible for the entire project and may be inexperienced in industry standards of mitigating risk.

Possibility of overspending.

Potential for inability to repay once the loan amortization which may result in default and foreclosure

Home Equity Lines of Credit (HELOCs) operate with a prime rate and typically maintain a low loan-to-value position. However, it's crucial to note that the interest rates associated with HELOCs are often higher than those of renovation loans. One significant concern with HELOCs is their notable failure rate, primarily due to the substantial risk of overspending. These credit lines can lead to financial challenges, especially if individuals do not exercise prudence in managing their expenditures. Additionally, HELOCs may feature an interest-only period, which, when it transitions into a full principal and interest payment, can pose affordability issues for borrowers. This potential mismatch between the borrowing capacity and the ability to meet increased payment obligations can contribute to financial strain and, in some cases, result in difficulties in repaying the borrowed amount. It underscores the importance of careful financial planning and consideration of one's ability to manage the evolving terms of a HELOC to avoid potential financial pitfalls.

The Big Threes of Renovation Loans

1. Forms

We've assembled all required forms into a convenient bundled packet, accompanied by a detailed checklist for both borrowers and contractors. Additionally, we offer an Excel spreadsheet designed to calculate renovation loan numbers efficiently. Our fee matrix provides a transparent breakdown of all costs associated with each renovation loan type, ensuring clarity and accuracy throughout the process.

2. Contractor Approval

Our contractors benefit from a specially designed one-pack for renovation loans, offering a streamlined and secure financial process. The unique advantage lies in having dedicated funds set aside, ensuring contractors never have to worry about payment uncertainties; the money is readily available in reserves.

Key Points for Contractors:

W9 and Contractor Agreement: Contractors are required to sign a W9 form and a contractor agreement to formalize their engagement in the renovation project.

Qualified Bid: Completing a qualified bid is essential for outlining the scope of the project and the associated costs, facilitating a transparent financial process.

Draw Schedule Notification: Contractors play a crucial role in determining the draw schedule, informing the lender in advance to maintain efficient fund disbursement.

Three Qualified References: Providing three well-qualified references is a requirement, establishing the contractor's reliability and competence in handling similar projects.

Managing Expectations:

The lender seeks assurance that contractors have a proven track record in handling projects of a similar nature. This information enables the lender to gauge the contractor's ability to effectively manage the renovation project.

Contractor Documentation

The lender expedites the contractor approval process by leveraging the state's website for a quick and efficient verification of the contractor's license and insurance details online. This streamlined approach allows for swift approval, demonstrating the lender's commitment to a seamless and efficient experience for both contractors and borrowers involved in the renovation project.

Bid:

Scope of work/bid (optional template provided)

License:

All renovation work must be performed by licensed contractor.

All licenses will be verified with state or local issuing agency.

If environmental safety items are included in repairs or appraisal, a verification of lead-based paint, mold, or radon licensing will be required.

Insurance:

Minimum requirement of $1 million provided on a certificate of liability.

W-9:

Current Year

Profile Report:

Completely filled out and signed.

Include 3 references within the last year, similar jobs in nurture, scope, and size.

Contract:

HomeStyle/CHOICE: Signed FNMA form 3730

203(K)/USDA/VA: Signed Homeowner Contractor Agreement

Bond:

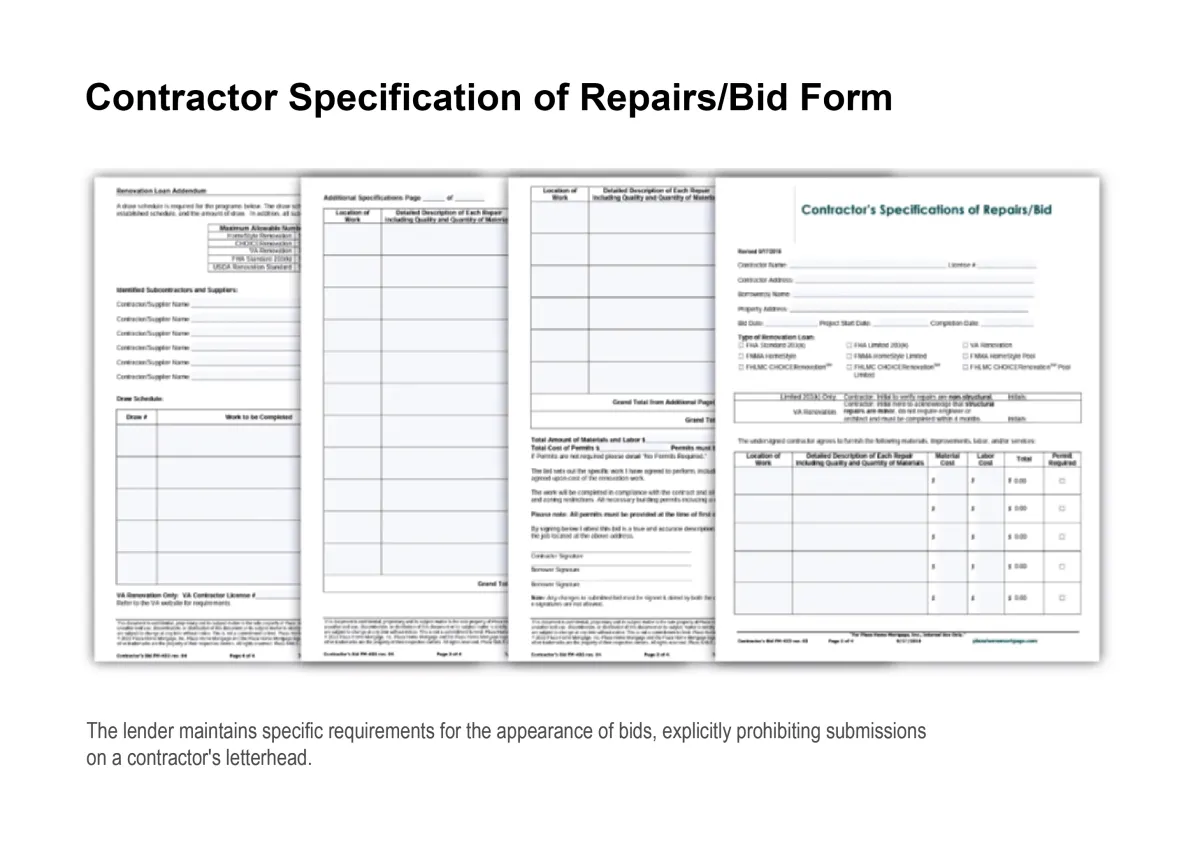

3. Contractor Specification of Repairs/Bid Form

The lender maintains specific requirements for the appearance of bids, explicitly prohibiting submissions on a contractor's letterhead. This stringent approach is driven by the lender's commitment to ensuring the borrower's construction project success. The bid serves as the sole document that outlines the anticipated outcomes and details the scope of the work. This meticulous adherence to bid guidelines is aimed at providing clarity and transparency to borrowers regarding the expected deliverables and the nature of the proposed work.

Our forms simplify the comprehension of the Work Write-Up for repairs and financing, benefiting borrowers, contractors, and HUD Consultants throughout the renovation process.

Renovation Loan Process

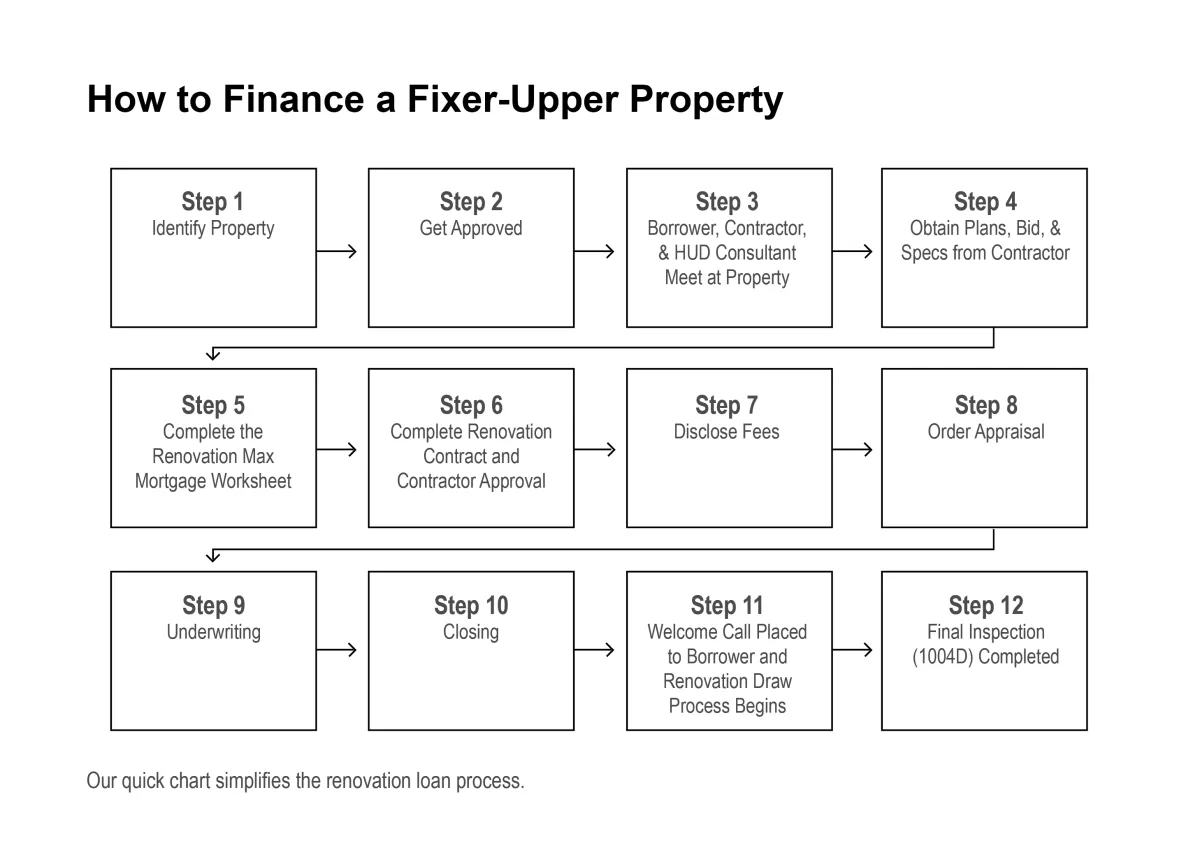

In the renovation loan process, the borrower often collaborates with a HUD Consultant to evaluate the property, leading to a collective planning session with stakeholders to measure necessary improvements. Bids are collected, and required forms are completed, facilitating the calculation of the final loan amount based on initial estimates. Initial disclosures with estimated fees are then sent out, offering a high estimate to account for potential costs. Subsequently, the bid is integrated into the appraisal, guaranteeing the inclusion of all necessary repairs. Concurrently, the loan's credit undergoes underwriting. Once these procedural steps are successfully completed, the loan concludes, enabling the planned renovation work to commence. This structured approach ensures a thorough assessment and preparation phase before the renovation process kicks off.

In a limited 203(k) loan, a licensed and bonded contractor can undertake the work, with the provision that they only bear the cost of materials, not the labor expenses.

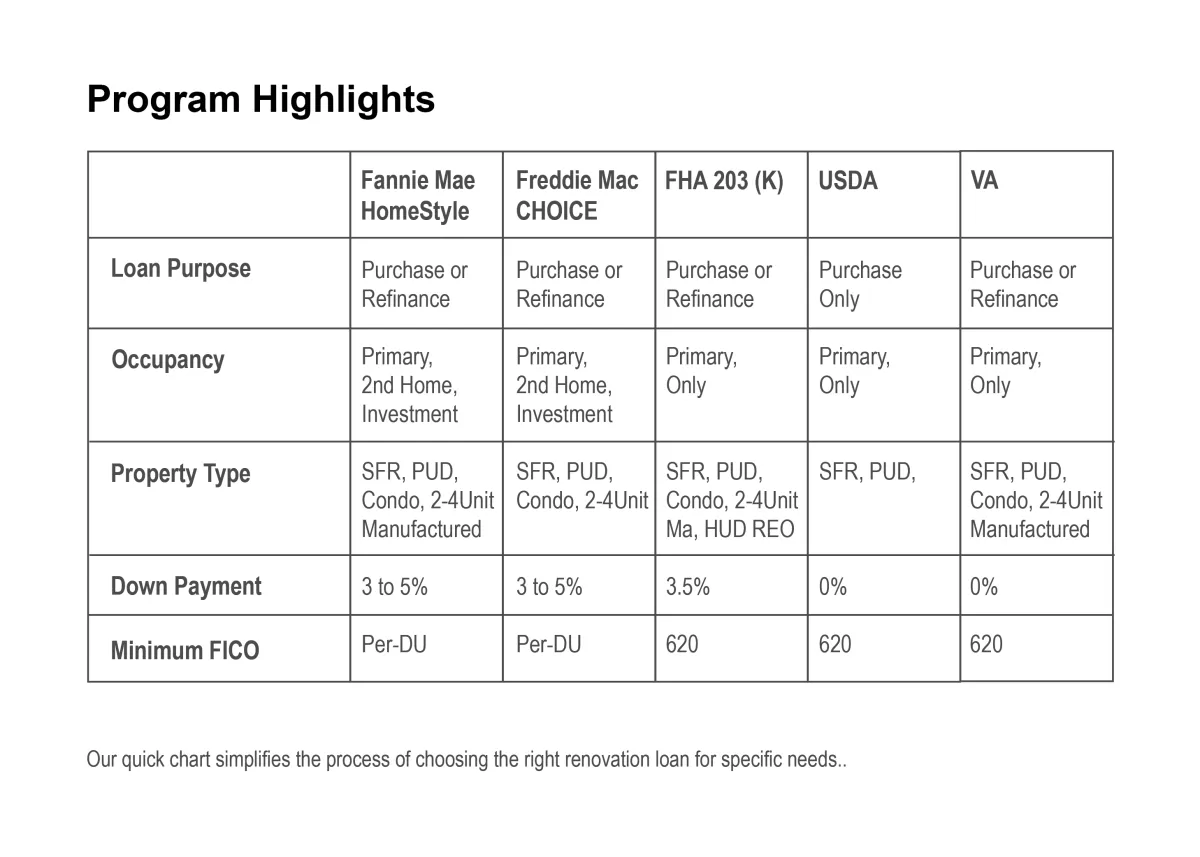

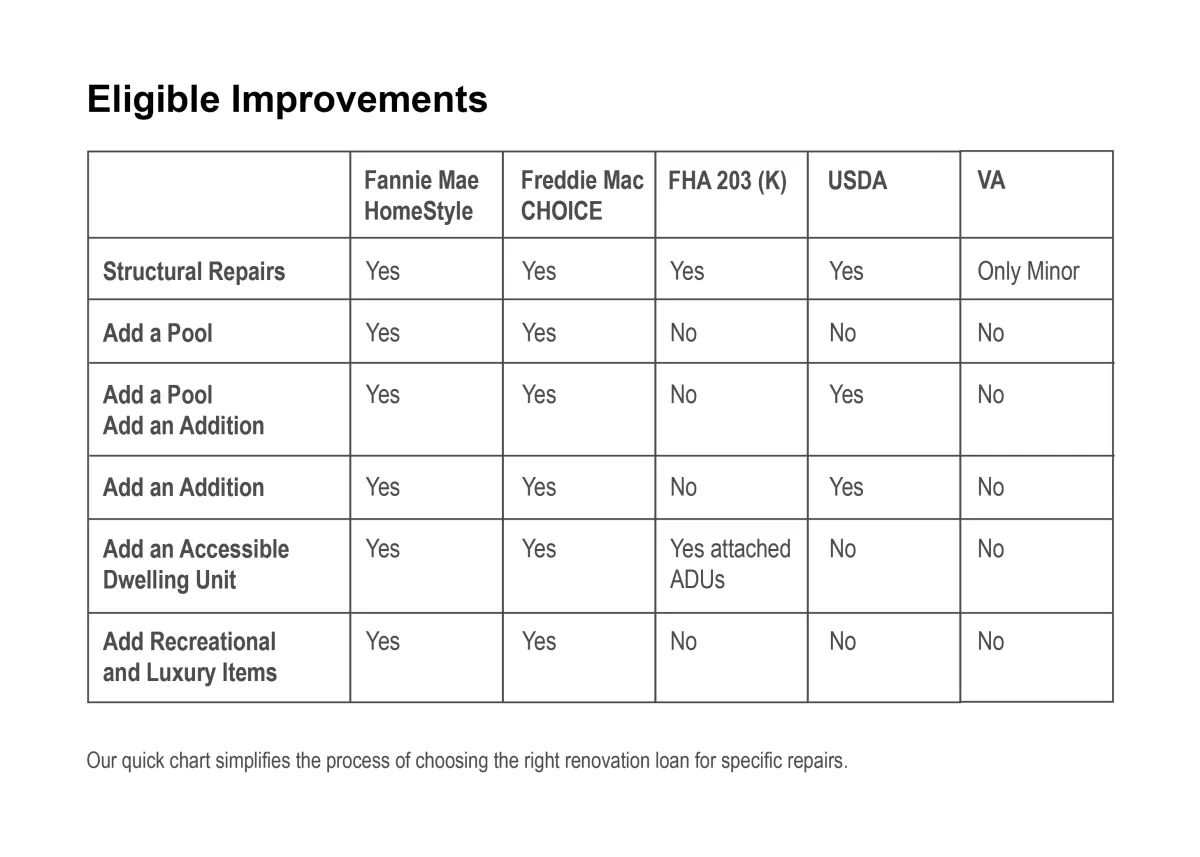

5 Renovation Loan Programs

Repairs and Improvements

Facilitate your renovation project with added convenience – our renovation loan allows you to include appliances like washers, dryers, and stoves. Streamline your home improvement journey by consolidating all your project needs into one comprehensive loan. Upgrade your space with ease and efficiency!

Build a Shop

Utilize a renovation loan to build a shop on your property. This financing option provides the funds needed to construct a new workspace, allowing you to enhance your property and tailor it to your needs.

Pool House, Deck, and Pool

Transform your property by adding a pool house, deck, and pool with a renovation loan. This financing option provides the means to create your ideal outdoor space, turning your vision into reality. Explore the opportunities for elevating your property into a personalized oasis.

Luxury Kitchen

Upgrade to a luxury kitchen with the help of a renovation loan. This financing solution allows you to invest in a high-end kitchen remodel, turning your culinary space into a stylish and functional masterpiece. Explore the possibilities of creating the kitchen of your dreams.

Ineligible Improvements

It's actually easier to explain what improvements that cannot be done.

Project cap set at $350,000, subject to higher limits with underwriter approval.

Improvements leading to commercial use or having a commercial nature restricted.

Conversion of a Single-Family Residential (SFR) dwelling into another SFR dwelling not permitted.

Exclusion of oil tank removal or repair from covered expenses.

Program ineligible for complete tear-down, foundation-up construction, and reconstruction of the dwelling.

Borrower Provided Material

Borrower Paid Material Guidelines:

Project cap set at $350,000, subject to higher limits with underwriter approval.

Improvements leading to commercial use or having a commercial nature restricted.

Conversion of a Single-Family Residential (SFR) dwelling into another SFR dwelling not permitted.

Exclusion of oil tank removal or repair from covered expenses.

Program ineligible for complete tear-down, foundation-up construction, and reconstruction of the dwelling.

Accessory Dwelling Units

Accessory Dwelling Units (ADU)

Our unique financing option is your sole choice when it comes to utilizing rental income for an Accessory Dwelling Unit (ADU) that hasn't been built yet. With our solution, you can leverage the potential rental income to qualify for the construction of your ADU. Choose the only option that empowers you to turn your ADU plans into reality while maximizing your financial capabilities.

Why Build an Accessory Dwelling Unit?

Long-Term Rental Unit

In Some areas an Airbnb

Children to Live In

Parents to Live In

A Separate Office from the Home

Place for Visitors to Stay

Building an Accessory Dwelling Units:

Build a Tiny Home Free Standing In the Back Yard with home style or choice that is not attached.

FHA 203(K) the ADU has to be attached.

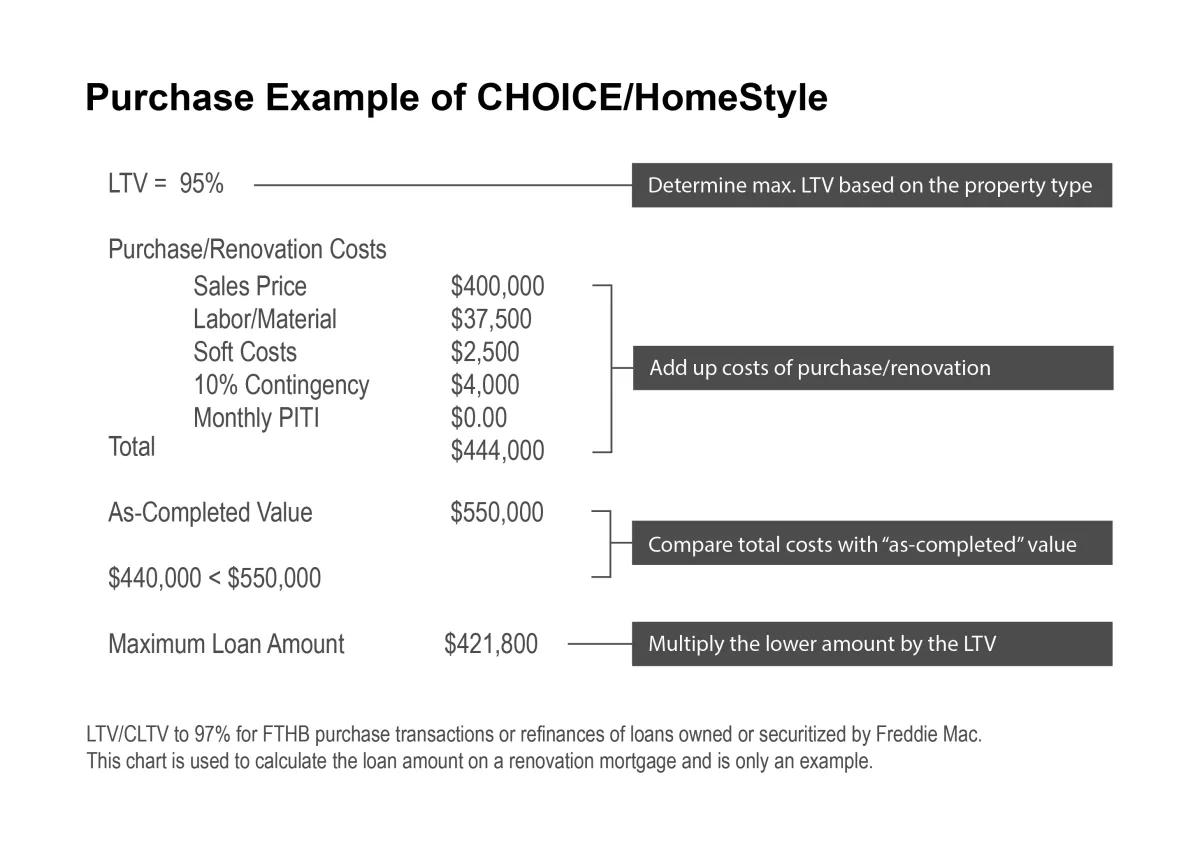

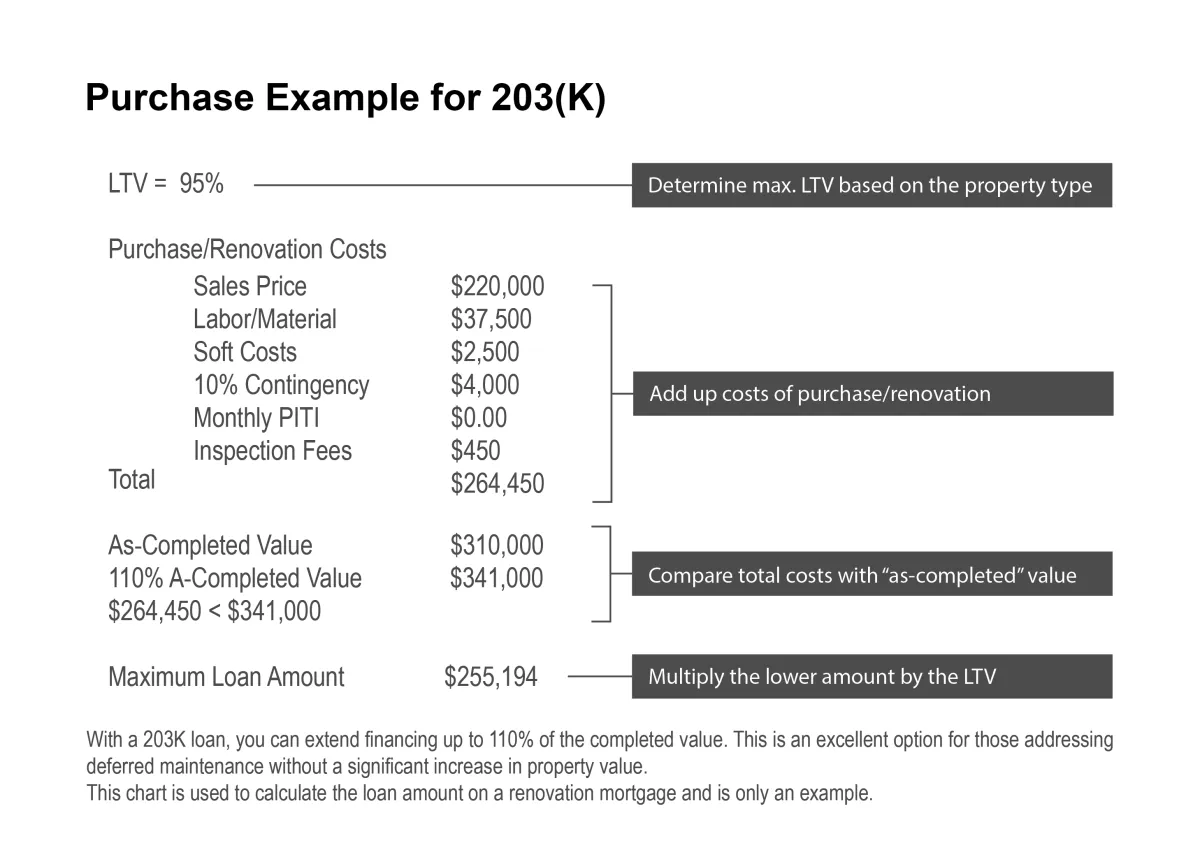

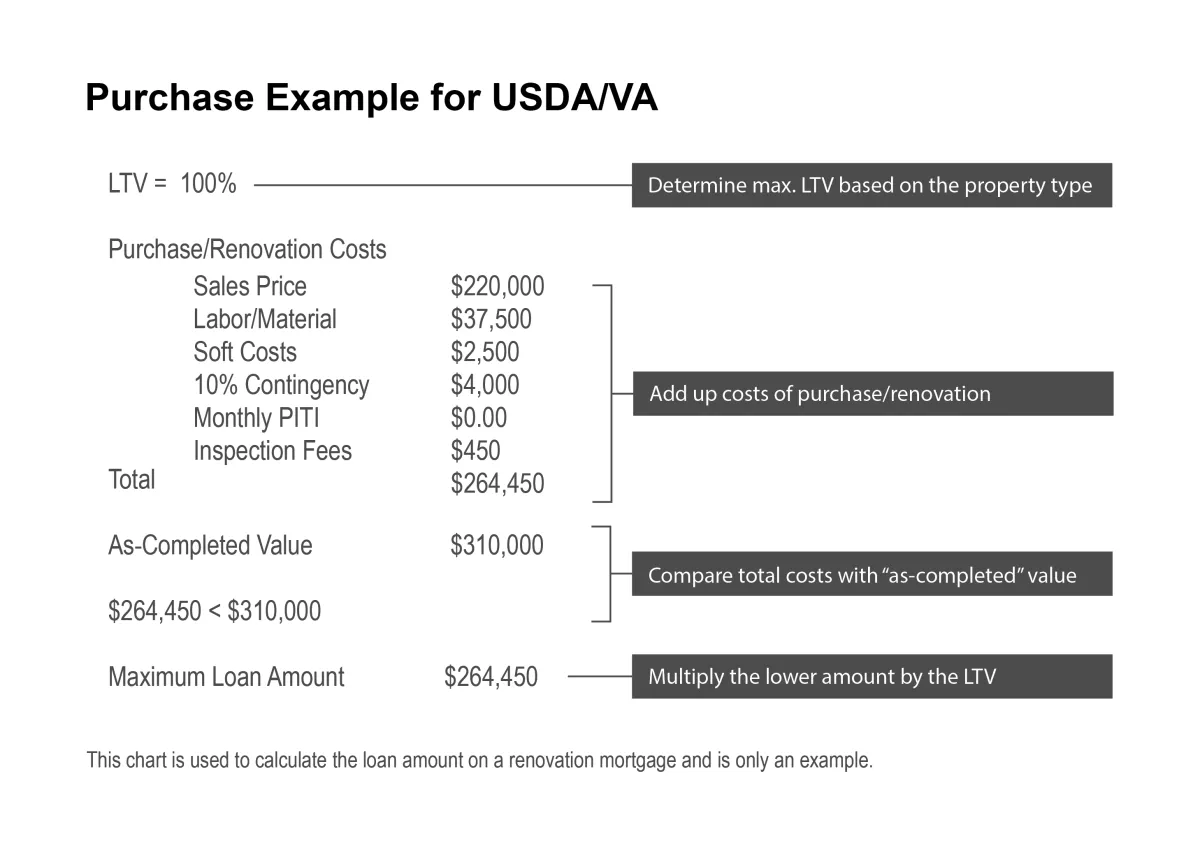

Calculating the Loan Amount

Our forms simplify the understanding of the Work Write-Up for repairs and financing, benefiting borrowers, contractors, and HUD Consultants in the renovation process.

The Renovation HomeSmart Loan strategy involves a careful assessment of both the purchase price and the renovation costs. The loan amount is determined by comparing the sum of the property purchase price and renovation costs with the appraised value after improvements. The loan amount is then determined by taking the lesser of these two values, ensuring a realistic and practical approach to financing based on the actual investment and improved property value. This method allows for a comprehensive evaluation, considering both the initial investment and the potential added value through renovations.

We have developed Excel spreadsheets tailored to each type of renovation loan product, offering a user-friendly interface for seamless calculations. These spreadsheets are designed to efficiently determine the loan amount by incorporating essential variables such as property purchase price, renovation costs, and post-improvement appraised value. The automated calculations within these spreadsheets provide users with a quick and accurate assessment, helping individuals make informed decisions about financing for their real estate and renovation endeavors.

In the case of a substantial renovation project where the borrower intends to remain in their rental property, there's a financing option available to address mortgage payments. This involves allocating a portion of the loan, typically covering one to six mortgage payments, and placing it into a repairs escrow. The funds from this escrow are then used to make the mortgage payments on behalf of the borrower during the construction period, allowing them to stay in their property without the burden of immediate mortgage payments. This approach provides financial flexibility for the borrower during the renovation, ensuring a more manageable and stress-free experience while their property undergoes significant improvements.

HUD Consultant

The HUD Consultant is the quarterback between the homeowner, the general contractors, and lender. The HUD Consultant is responsible for the work to be done correctly, timely, and professionally. The role of FHA 203(K) HUD Consultant is to make sure that the construction funds are properly spent on the project and the project goes smoothly.

Refer to HUD’s website for a list of approved consultants: https://entp.hud.gov/idapp/html/f17cnsidata.cfm

1. Site Visit - Meets borrower at site, inspects property, consults with borrowers as to what must be repaired and what they want to renovate. For the borrower's protection, a home inspection is always recommended. This provides the borrower and HUD consultant with a working list. Borrower pays appropriate fee; fee can be financed and reimbursed.

2. Work Write-Up (WWU) - The 35 point Work Write-Up, prepared by the HUD Consultant, identifies each Work Item to be performed and the specifications for completion of the repairs or improvement, including permits, health and safety, and required exhibits. This also includes the HUD Consultant’s fee and Identity of Interest statements delivered to the contractor, borrower, and lender.

Generally, if the repairs are over $75K the lender will require a HUD Consultant to complete a Work Write-Up. The HUD Consultant knows how to complete the paperwork correctly. It can be confusing for a homeowner to complete the paperwork for draw requests. A HUD Consultant is able to be hired on all types of renovation loans.

3. Feasibility Study - The lender does not require a Feasibility study unless the borrower has requested one. If a Feasibility Study was performed to determine if the project is financially feasible, a copy of the study must be provided in the loan file regardless whether the cost was financed.

4. Inspection Fees - Must provide an invoice for actual costs of draw inspection and mileage prior to closing.

5. W-9 - Must provide a W-9 for the current year.

6. Number of Draws - HUD Consultant will determine the number of draws needed.

7. Number of Draws - The HUD Consultant will perform an inspection, prepare a report, and fill out a draw request form, signed by the HUD Consultant, borrower, and contractor. The HUD Consultant will then provide this paperwork to the lender as the lender at the time of each draw.

8. Updated Appraisal - At time of renovation completion and final draw, the appraisal will be updated with final inspection and 1004(d).

How the Borrower Gets through the Draw Process

Supplier/Materials Draw at Closing

Navigating draw requests in a renovation loan demands a clear understanding of its specific guidelines. Here are key points to comprehend:

Draw Limitation: Draws are exclusively reserved for material expenses and do not cover labor costs.

Form Requirement: A specific form is mandated to initiate a draw request.

Two-Party Check Issuance: In cases where materials are prepaid or scheduled for payment by the borrower or contractor, a two-party check is issued at closing, directed to both the contractor and borrower.

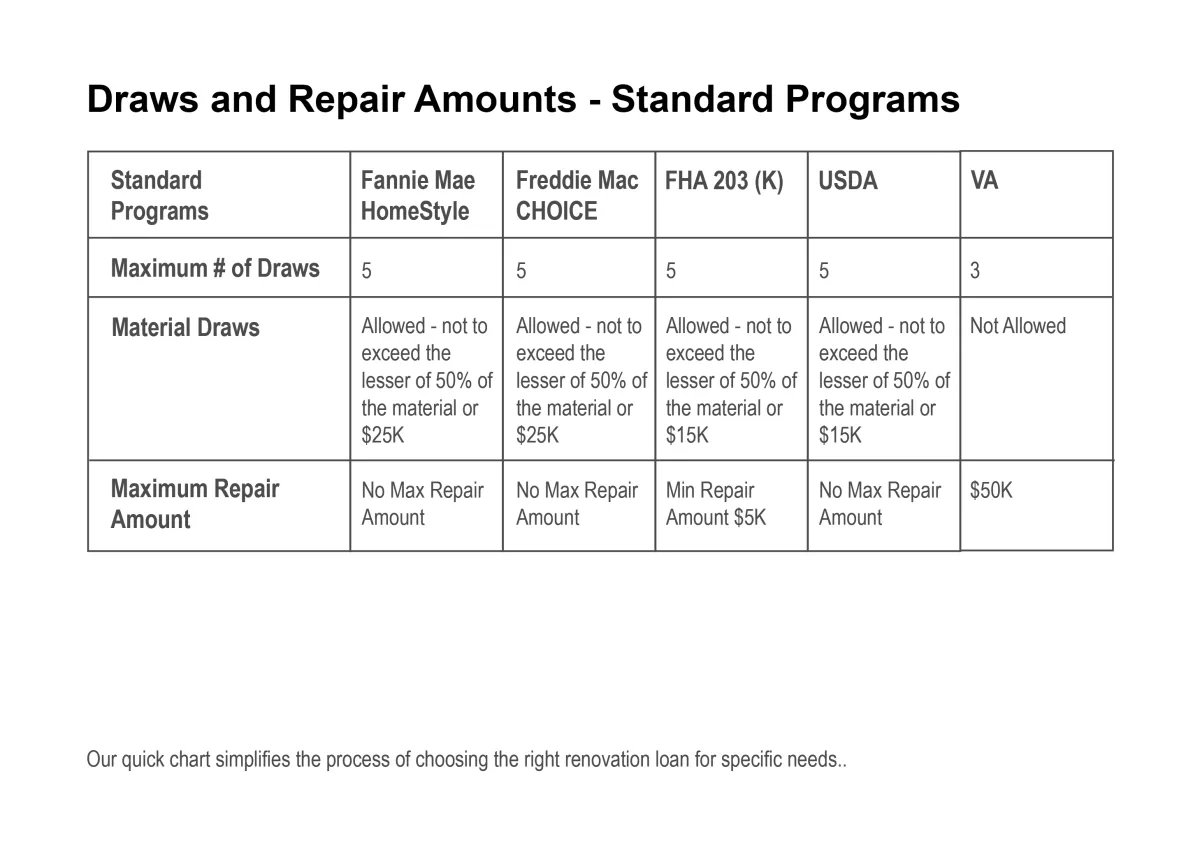

Cap on Material Draw: Material draw amounts are capped at 50% of the material cost, with HomeStyle/Choice not exceeding $25,000 and 203(K)/USDA not surpassing $15,000. This advance may occur during the closing process.

Detailed Documentation: Comprehensive documentation on the bid and work write-up is essential, detailing the types, quantities, and the total amount of the material draw.

Exclusion of Labor Costs: Borrowers cannot be reimbursed for down payments or deposits made to contractors, as material draws are strictly designated for material expenses, excluding labor.

Separation from Max Draws: Material draws are distinct and not included in the maximum allowance of 5 draws permitted during the renovation process. Understanding these guidelines ensures a smooth and well-documented draw request procedure.

Holdback Fund

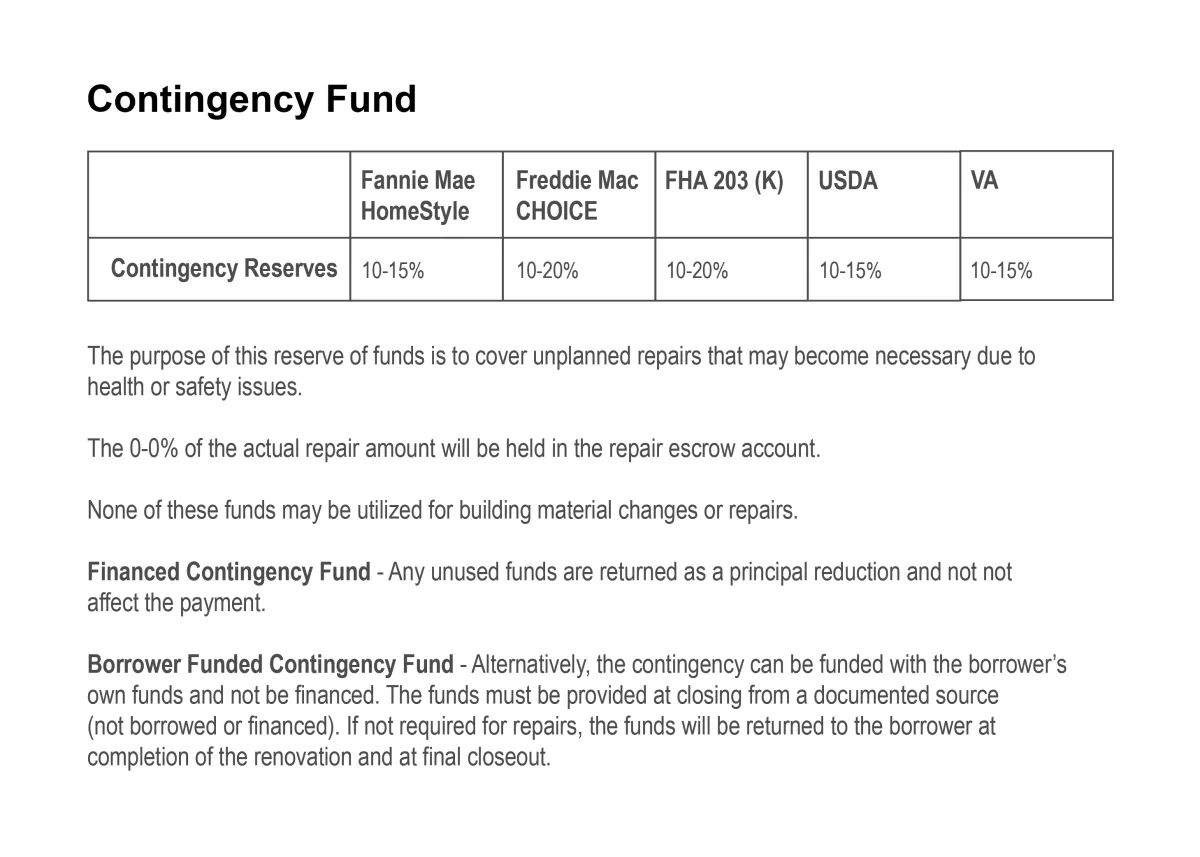

10% of the total draw request amount will be withheld and held in the repair escrow account until the entire project is finished. For instance, if a $1,000 draw is requested, the lender will issue a check for $900, while the remaining $100 will be retained in the repair escrow account. All withheld funds will be released after confirming the completion of all work and ensuring the property's title is free of any liens.

Draw Process

The draw team operates within a timeframe of 5 business days to issue a check. A draw delay indicates an incomplete draw request, prompting the lender to send a notification to the involved parties, urging them to complete the necessary paperwork promptly. This proactive approach ensures a timely and efficient disbursement process for the renovation project.

Borrower will notify the lender a the time of Draw Inspection and provide the following:

Draw Request

Lien Waiver

Inspection

The Lender will issue a 2-Party check made out to:

Borrower and

Contractor

Photographs are required to document completion of renovation.

Timing and Occupancy

10% of the total draw request amount will be withheld and held in the repair escrow account until the entire project is finished. For instance, if a $1,000 draw is requested, the lender will issue a check for $900, while the remaining $100 will be retained in the repair escrow account. All withheld funds will be released after confirming the completion of all work and ensuring the property's title is free of any liens.

Contact Me About a Renovation Loan

We appreciate your interest in our mortgage services.

Jeff Carlston is a Licensed Loan Officer NMLS #315077 with Augusta Lending Utah NMLS# 353774 Align Lending Michigan NMLS# 2041154

Augusta Lending - Utah

NMLS 353774

Align Lending - Michigan NMLS#2041154

Renovation Loan Flyers

About Renovation Loans

Renovation Loan Webinars

The information provided on this page is for general informational purposes only and is not financial advice. Loan products and terms are subject to change. Specific eligibility and terms may vary based on individual circumstances. This website is not a lender, and loan approval is subject to credit approval by the lender. Use of this site does not create a client-lender relationship.

Any reliance on the information presented is at your own risk. Consult with a qualified loan officer before making any financial decisions. We strive for accuracy but make no warranties about the completeness, accuracy, or suitability of the information. We are not liable for any loss or damage arising from the use of this website. This disclaimer is subject to change without notice. Accessing and using this website indicate your agreement with these terms.