Renovation Home Loans

Renovation loans offer a valuable opportunity for homebuyers or homeowners looking to enhance their properties. These loans provide the flexibility to finance both the home purchase or refinance and the renovation costs, consolidating them into a single loan. The process involves obtaining an appraisal based on the anticipated post-renovation value of the property, allowing the loan to be structured around the future value rather than its current state.

Who Understands Renovation Loans?

Many loan officers and real estate agents lack a deep understanding of renovation loans, but we specialize in guiding you through the process. Whether you're a homebuyer or homeowner, trust our expertise to simplify renovation financing and turn your vision into reality. Count on us for a dedicated and knowledgeable partner in your home transformation journey.

Meet Jeff, Your Renovation Loan Expert!

Jeff is your go-to guide for seamless renovation financing. With a wealth of experience, he specializes in turning your home improvement dreams into reality. From tailored solutions to a commitment to client satisfaction, he is your dedicated partner throughout the entire financing process

Ready to Renovate? We're Ready to Help!

Home Loans Made Simple!

Join a Renovation Loans Webinar

Ready to transform your home? Join Jeff in our upcoming webinar for expert insights and personalized advice. Register now to take the first step towards your dream renovation!

Unlock the Secrets to Successful Home Renovation! Join our exclusive webinar for expert insights, tips, and strategies on transforming your space. Register now to secure your spot and embark on a journey to your dream home. Don't miss out – reserve your place today for a renovation experience like never before!

Renovation Loan Webinar Outline:

Why Should I Get a Renovation Loan?

Renovation Programs

Calculating the Loan Amount

Repairs and Improvements

Forms, Contractors, and Bids

What to Do After Closing

Draw Process

Resources

Renovation loans provide the financial means to transform an existing property into a more contemporary and functional space.

In the contemporary housing landscape, there is a prevalent desire for residing in newly constructed homes. However, properties surpassing the 25-year mark often exhibit an outdated appearance, lacking the allure of a freshly built residence. The remedy to rejuvenate such existing homes and infuse them with modern style and advanced technological features lies in the accessibility of renovation loans. These financial instruments serve as a practical solution, facilitating the transformation of older homes into aesthetically refreshed spaces, equipped with the latest in technology and design.

Here are some key benefits and considerations:

Modernization and Technology

Integration

Increased Property Value

Customization

Energy Efficiency (Home's IQ)

Preservation of Charm

Financial Assistance

Expert Guidance

Compliance with Building Codes

Make Over the Exterior & Interior

Improve Maintenance

Make More Room

Make Your Home Even Better

Boost your home's worth with strategic renovations that offer substantial returns. Discover the top projects that promise long-term value for your investment. Choose wisely to enhance both the aesthetic appeal and financial value of your property.

Bathroom Boost

Tub

Toilet

Sink/Vanity

Flooring

Fixtures

Lively Landscaping

Fresh Sod

Colorful Plants

Walkways

Pool/Pool House

Outdoor Kitchen

Decks

Exterior Enhancement

Freshen Paint

Replace Siding

Update Entry

Spiced-Up Kitchen

Upgrade Oven

Cooktop

Sink

Fixtures

Flooring

Accessory Dwelling Units (ADU)

Our unique financing option is your sole choice when it comes to utilizing rental income for an Accessory Dwelling Unit (ADU) that hasn't been built yet. With our solution, you can leverage the potential rental income to qualify for the construction of your ADU. Choose the only option that empowers you to turn your ADU plans into reality while maximizing your financial capabilities.

Why Build an Accessory Dwelling Unit?

Long-Term Rental Unit

In Some areas an Airbnb

Children to Live In

Parents to Live In

A Separate Office from the Home

Place for Visitors to Stay

Building an Accessory Dwelling Units:

Build a Tiny Home Free Standing In the Back Yard with home style or choice that is not attached.

FHA 203(K) the ADU has to be attached.

Our forms simplify the understanding of the Work Write-Up for repairs and financing, benefiting borrowers, contractors, and HUD Consultants in the renovation process.

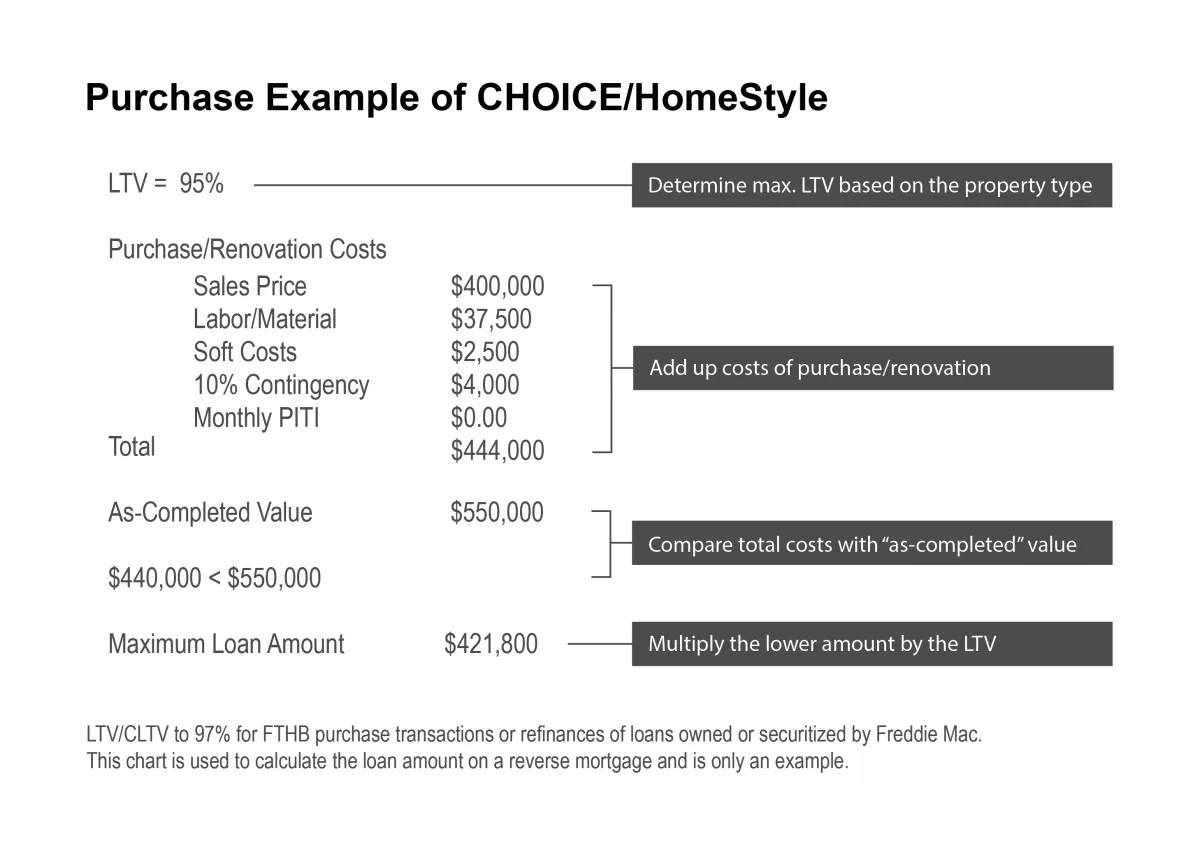

The Renovation HomeSmart Loan strategy involves a careful assessment of both the purchase price and the renovation costs. The loan amount is determined by comparing the sum of the property purchase price and renovation costs with the appraised value after improvements. The loan amount is then determined by taking the lesser of these two values, ensuring a realistic and practical approach to financing based on the actual investment and improved property value. This method allows for a comprehensive evaluation, considering both the initial investment and the potential added value through renovations.

We have developed Excel spreadsheets tailored to each type of renovation loan product, offering a user-friendly interface for seamless calculations. These spreadsheets are designed to efficiently determine the loan amount by incorporating essential variables such as property purchase price, renovation costs, and post-improvement appraised value. The automated calculations within these spreadsheets provide users with a quick and accurate assessment, helping individuals make informed decisions about financing for their real estate and renovation endeavors.

What are some types of repairs to get the biggest bang for you buck?

Garage Door Replacement

Roofing Replacement

Deck Addition

Bathroom Remodel

Major Kitchen Remodel

Master Suite Addition

Bathroom Addition

New Work from Home Space

and More

Provides the Opportunity to Add Equity

In an educational context, it's essential to recognize the inherent uncertainties in real estate investments, even when utilizing renovation loans. No guarantees can be made regarding the specific amount of improvement or return on investment. Emphasizing thorough research, understanding potential risks, and realistic expectations is crucial. Real estate markets are influenced by various factors, and unforeseen challenges may arise during renovation projects. Educational discussions should underscore the importance of prudent financial planning, consultation with professionals, and a realistic awareness of market dynamics.

Renovation Loans VS HELOCs for Home Renovation

Renovation Loans

Loan amount takes into consideration proposed renovations.

Rates are lower than HELOCs.

HUD Consultant Available.

Costs are set before construction begins.

No drastic increase in loan payments.

HELOCs

Loan amount is based on the amount of the existing or “as is” equity in the home.

Rates are higher than Renovation Loans.

Borrower is responsible for the entire project and may be inexperienced in industry standards of mitigating risk.

Possibility of overspending.

Potential for inability to repay once the loan amortization which may result in default and foreclosure

Home Equity Lines of Credit (HELOCs) operate with a prime rate and typically maintain a low loan-to-value position. However, it's crucial to note that the interest rates associated with HELOCs are often higher than those of renovation loans. One significant concern with HELOCs is their notable failure rate, primarily due to the substantial risk of overspending. These credit lines can lead to financial challenges, especially if individuals do not exercise prudence in managing their expenditures. Additionally, HELOCs may feature an interest-only period, which, when it transitions into a full principal and interest payment, can pose affordability issues for borrowers. This potential mismatch between the borrowing capacity and the ability to meet increased payment obligations can contribute to financial strain and, in some cases, result in difficulties in repaying the borrowed amount. It underscores the importance of careful financial planning and consideration of one's ability to manage the evolving terms of a HELOC to avoid potential financial pitfalls.

Contact Me About a Renovation Loan

We appreciate your interest in our mortgage services.

Jeff Carlston is a Licensed Loan Officer NMLS #315077 with Augusta Lending Utah NMLS# 353774 Align Lending Michigan NMLS# 2041154

Augusta Lending - Utah

NMLS 353774

Align Lending - Michigan NMLS#2041154

Renovation Loan Flyers

About Renovation Loans

Renovation Loan Webinars

The information provided on this page is for general informational purposes only and is not financial advice. Loan products and terms are subject to change. Specific eligibility and terms may vary based on individual circumstances. This website is not a lender, and loan approval is subject to credit approval by the lender. Use of this site does not create a client-lender relationship.

Any reliance on the information presented is at your own risk. Consult with a qualified loan officer before making any financial decisions. We strive for accuracy but make no warranties about the completeness, accuracy, or suitability of the information. We are not liable for any loss or damage arising from the use of this website. This disclaimer is subject to change without notice. Accessing and using this website indicate your agreement with these terms.